Published on

€172m SBCI funding drawn down in past 10 months

The results from the Strategic Banking Corporation of Ireland (SBCI) for its first 10 months of lending are in, and they show positive signs for small businesses looking to access finance.

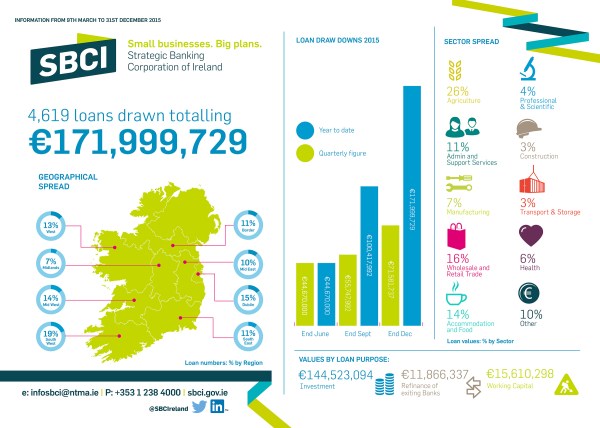

Over 4,600 SBCI loans totalling some €172 million have been drawn down by Irish businesses since March 2015. In Quarter 4 2015 alone, €71.5 million worth of loans were granted.

SBCI, whose overall aim is to make it easier for small business to access dynamic and flexible finance to build and grow their business, began lending to the SME market last March.

Loan uptake on a quarterly basis has been gathering momentum since then, with Quarter 4 2015 up 28% on the previous quarter with €71.5 million in loans drawn down. The agricultural sector accounted for more than a quarter of loans, followed by the wholesale and retail trade at 16%.

The average loan size has also increased 19% to €37,000 on the previous quarter with the vast majority of businesses borrowing for investment purposes. Loans sizes varied widely from €1,200 to €4 million.

SBCI has seen the highest loan uptake occurring in the South-West (19%), followed by Dublin (15%) and the Mid-West (14%).

(Click on infographic for larger version)

What is SBCI?

SBCI aims to provide Irish small and medium businesses with flexible funding by offering:

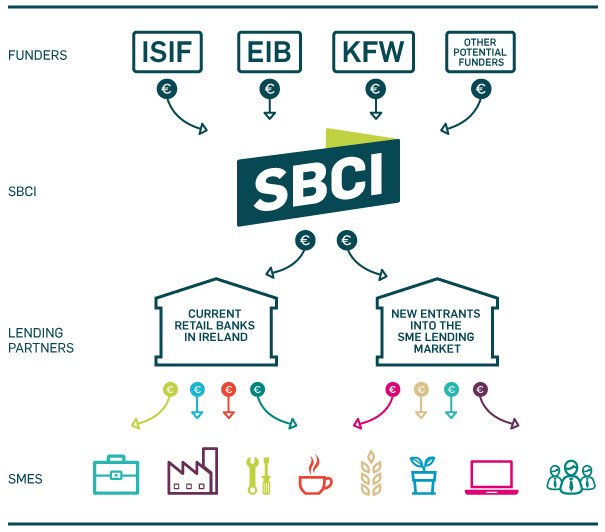

- Lower cost funding to financial institutions which is passed on to SMEs

- Flexible products with longer maturity and capital repayment flexibility, subject to credit approval

- Market access for new entrants to the SME lending market, creating real competition

All of these elements create a more competitive and dynamic environment for SME funding.

How does it work?

SBCI loans are made available to businesses through bank and non-bank financial institutions. SBCI now works with four on-lenders: AIB and Bank of Ireland, and now Merrion Fleet and Finance Ireland. An SME can borrow up to €5m, which is likely to cover the needs of most Irish SMEs. SBCI’s goal is to facilitate the delivery of lower cost, innovative and accessible funding to Irish SMEs, through a suite of flexible products offered by a wider range of financial institutions than is currently available in the Irish market.

For more information

Check out the SBCI's website.

Hear from Konihoor Foods about how they used SBCI funding to grow their business.